10 tips to help you boost your retirement savings — whatever your age

Share:

Whether you just started working or you're nearly ready to leave the workforce, you can still potentially grow your nest egg.

When planning for retirement, the truth is the earlier you start saving, the better off you could be, thanks to the power of compound interest. But even if you began saving late or have yet to begin, it's important to know you're not alone, and there are steps you can take to increase your retirement savings. "It's never too late to get started," says Christopher Vale, senior vice president, Consumer Investments, Bank of America.

Consider the following tips, which can help you boost your savings — regardless of your current stage of life — and pursue the retirement you envision.

1. Focus on starting today

If you're just beginning to put money away for retirement, start saving as much as you can now. That way you let compound interest — the ability of your assets to generate earnings, which are reinvested to generate their own earnings — have an opportunity to work in your favor. "The earlier you can get started, the better off you'll be," Vale says.

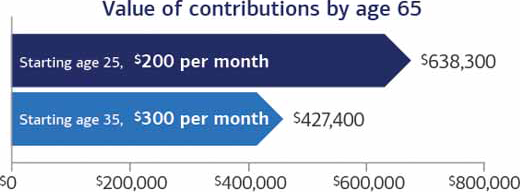

Starting to invest early on — even just a small amount — may help you in retirement

By starting to put away money earlier, a 25-year-old investing approximately $200 per month ($2,400/year) accumulates more assets by age 65 than if he or she had started to invest $300 per month ($3,600/year) at age 35 — despite investing less each period. Investing a smaller dollar amount over a long time can have a greater impact on investment results than investing a larger dollar amount for a shorter period.

The value of a hypothetical investor's retirement contributions by age 65 could be $491,648 if they saved $200 per month starting at age 25 and $346,239 if they saved $300 per month starting at age 35.

The value of a hypothetical investor's retirement contributions by age 65 could be $491,648 if they saved $200 per month starting at age 25 and $346,239 if they saved $300 per month starting at age 35.This assumes an average annual nominal return of 7.1% compounded annually.

Source: Investor.gov Compound Interest Calculator, accessed October 2025. This example is hypothetical and does not represent the performance of a particular investment. Results will vary. Actual investing includes fees and other expenses that may result in lower returns than this hypothetical example.

2. Contribute to your 401(k) account

If your employer offers a traditional 401(k) plan and you're eligible, it may allow you to contribute pre-tax money, which can potentially be a significant advantage. Say you're in the 12% tax bracket and plan to contribute $100 per pay period. Since that money comes out of your paycheck before federal income taxes are assessed, your take-home pay will drop by only $88. You may save on state and local income taxes as well, though you'll still owe Social Security and Medicare tax. That means you can invest more of your income without feeling it as much in your monthly

budget.Footnote 1 If your employer's 401(k) plan also offers a Roth 401(k) feature, in which contributions are made with after-tax dollars, you should consider what your income tax bracket is likely to be in retirement to help you decide whether this is the right choice for you. Even if you leave that employer, you have choices on

what to do with your 401(k) account.

3. Meet your employer's match

"If your employer offers to match your 401(k) plan contributions, make sure you contribute at least enough to take full advantage of the match," Vale says. For example, an employer may offer to match 50% of employee contributions up to 5% of your salary. That means if you earn $50,000 a year and contribute $2,500 to your retirement plan, your employer would kick in another $1,250. It's essentially free money. Don't leave it on the table.

4. Open an IRA

Consider establishing an individual retirement account (IRA) to help build your nest egg. You have two options: a traditional IRA or a Roth IRA. A

traditional IRA may be right for you depending on your income and whether you or your spouse are eligible to participate in a workplace retirement plan. Contributions to a traditional IRA may be tax deductible, and the potential investment earnings have the opportunity to grow tax deferred until you make withdrawals during retirement. If your income is under the modified adjusted gross income limits, which are based on your federal tax filing status, a

Roth IRA may be a good choice for

you.Footnote 2 A Roth IRA is funded with after-tax contributions, so once you have turned age 59½, qualified distributions, including any potential earnings, are federal income tax-free (and may be state income tax-free) if certain holding period requirements are satisfied. To determine what type of IRA could work best for you, go to

the Merrill Retirement Account Selector Tool and

view the most current 401(k) and IRA contribution limits (PDF).

5. Take advantage of catch-up contributions if you're age 50 or older

One reason it's important to start saving early if you can is that yearly contributions to IRAs and 401(k) plans are limited. The good news? As of the calendar year you reach age 50, you're eligible to go beyond the normal limits with

catch-up contributions to IRAs and 401(k)s (PDF).

Footnote 3 If you're between the ages of 60 and 63, you can make even larger catch-up contributions to your 401(k), plan rules permitting. So if over the years you haven't been able to save as much as you would've liked, catch-up contributions can help boost your retirement savings.

6. Automate your savings

You've probably heard the phrase "pay yourself first." Make your retirement contributions automatic each month, and you'll have the opportunity to potentially grow your nest egg without having to think about it, Vale says. You can automate your investment selection with the Merrill Automatic Investment Plan, which invests assets automatically in specific funds.Footnote 4

7. Rein in spending

Examine your budget. You might negotiate a lower rate on your car insurance or save by bringing your lunch to work instead of buying it. Using an online tool like our

cash flow calculator can help you determine where your money is going — and

find places to reduce spending so you have more to save or invest.

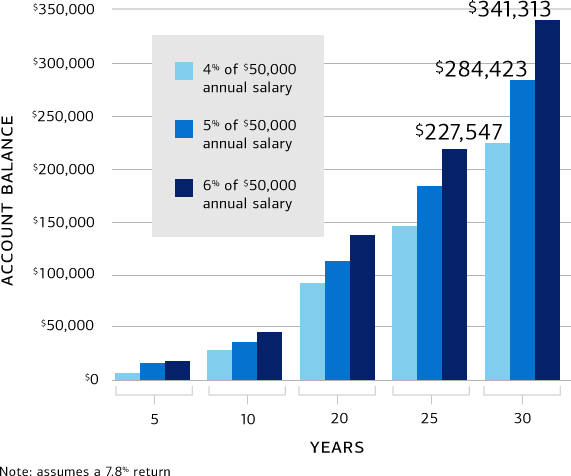

Your contribution rate: A little extra can help make a big difference

How much you contribute to your retirement plan account today can make a big difference in how much you have when you're ready to retire. Just increasing your contribution rate from 4% to 6% could add nearly $100,000 to your nest egg over 30 years, assuming a $50,000 salary.

A person who earns $50,000 and invests for 30 years would have $191,586 if they invested 4% of their annual salary, $240,059 if they invested 5% of their annual salary and $288,532 if they invested 6% of their annual salary, assuming a 7.1% annual return.

A person who earns $50,000 and invests for 30 years would have $191,586 if they invested 4% of their annual salary, $240,059 if they invested 5% of their annual salary and $288,532 if they invested 6% of their annual salary, assuming a 7.1% annual return.Investing in securities involves risks, and there is always the potential of losing money when you invest in securities.

Source: Investor.gov Compound Interest Calculator, accessed October 2025.

8. Set a goal

Knowing how much you may need can not only help you better understand why you're saving, but also can make it more rewarding. Set benchmarks along the way and gain satisfaction as you pursue your retirement goal. Use the

Personal Retirement Calculator to help determine at what age you may be able to retire and how much you may need to invest and save to do so.

9. Stash extra funds

Extra money? Don't just spend it. Every time you receive a raise, increase your contribution percentage. Dedicate at least half of the new money to your retirement plan account. And while it may be tempting to take that tax refund or salary bonus and splurge on a new designer purse or a vacation, "don't treat those extra funds as found money," Vale says. His advice is to treat yourself to something small and use the rest to help make bigger leaps toward your retirement goal.

10. Consider delaying Social Security as you get closer to retirement

"This is a big one," Vale says. "For every year you can

delay receiving a Social Security payment before you reach age 70, you can increase the amount you receive in the future." Age 62 is the earliest you can begin receiving Social Security retirement benefits, but they will be reduced if taken before your full retirement age (67 for people born in 1960 or later). For each year you wait (until age 70), your monthly benefit will increase, and the additional income adds up quickly. Pushing your retirement back even one year could make a significant

difference.Footnote 5 It can also increase potential future survivor benefits for your spouse.

"Recognizing the need to put money away for retirement is the first step," Vale says. Understand how much you want to sock away for retirement and find creative ways to increase your contributions. Starting too late and saving too little are common regrets among retirees. Making the effort now can help you look forward to retirement.

Share:

Footnote 1 Income tax will be due upon withdrawal, and you may be subject to a 10% additional federal tax for withdrawals prior to age 59½ unless an exception applies.

Footnote 2 Contributions to Roth IRAs begin to phase out at different modified adjusted gross income ranges for married taxpayers filing jointly, married taxpayers filing separately and singles or heads of households. Please see

Roth IRA Contribution Limits (PDF) for specific income amounts.

Footnote 3 Internal Revenue Service, "Retirement Topics — Catch-Up Contributions," August 2025.

Footnote 4 Please keep in mind that an automatic investment plan does not ensure a profit or protect against loss in declining markets. Such a plan involves continuous investment in securities regardless of fluctuating price levels; investors should carefully consider their financial ability to continue their purchases through periods of fluctuating price levels.

Footnote 5 Social Security Administration, "Delayed Retirement Credits," accessed October 2025.

Hypothetical performance results have certain inherent limitations. Hypothetical returns do not represent actual investments and are achieved through the retroactive application of investment returns with the benefit of hindsight. No representation is made that a client will achieve results similar to those shown. No representation is made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved. The hypothetical results and performance streams used to compile the hypothetical performance may be materially different from the client's actual holdings.

Merrill, its affiliates, and financial advisors do not provide legal, tax, or accounting advice. You should consult your legal and/or tax advisors before making any financial decisions.

MAP8627350-05142027