How much do you really need to save for retirement?

Share:

Use these insights to help determine whether your retirement plan is on the right track

Ask three financial experts how much you need to save for retirement, and you might get three different answers: a specific number, say $1 million; a figure based on future spending, such as enough to draw down 80% to 90% of your pre-retirement income every year; or a simple formula, like saving 12 times your pre-retirement salary. But what's right for you? And how do you know you're on track?

"Because there are so many variables, even the retirement researchers can't agree on a total dollar amount," says Ben Storey, director of Retirement Research & Insights at Bank of America. "What each person needs will vary based on a number of factors." These factors include your current age; the age at which you plan to retire or could be forced to retire due to health, the loss of a job or other circumstances beyond your control; how long you expect to live based on family history; how much you plan to spend in retirement; and what your

sources of retirement income will be.

Why no single retirement target covers everyone

"Tempting as it is to put a single number on retirement, the answer to how much you'll need to save really depends on the life you expect to lead," Storey says. "For some people, $1 million in savings may be plenty; others might need more — or less."

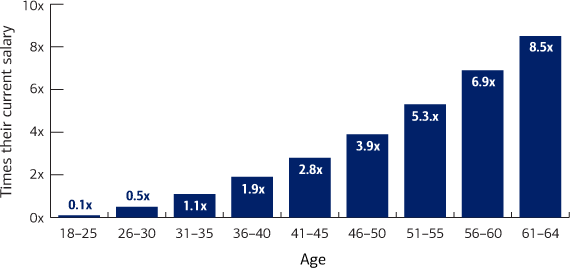

As a useful starting point, the chart below shows how much someone making $40,000 to $100,000 annually should have saved, depending on their age, if they hope to replace 38% of their pre-tax income with retirement savings. If that's your goal, for example, you should aim to have 2.5 times your salary saved by the time you reach ages 36 to 40, according to Bank of America's Financial Wellness Tracker.Footnote 1

How much should you be saving for retirement?

Consider using the following savings multiples from Bank of America's Financial Wellness Tracker as guidance for replacing your income in retirement:

The amount you should have saved for retirement based on your age: Between 18 and 25, 0.3 times your current salary. Between 26 and 30, 1.0 times your current salary. Between 31 and 35, 1.7 times your current salary. Between 36 and 40, 2.5 times your current salary. Between 41 and 45, 3.5 times your current salary. Between 46 and 50, 4.7 times your current salary. Between 51 and 55, 6.1 times your current salary. Between 56 and 60, 7.7 times your current salary. Between 61 and 64, 9.2 times your current salary.

The amount you should have saved for retirement based on your age: Between 18 and 25, 0.3 times your current salary. Between 26 and 30, 1.0 times your current salary. Between 31 and 35, 1.7 times your current salary. Between 36 and 40, 2.5 times your current salary. Between 41 and 45, 3.5 times your current salary. Between 46 and 50, 4.7 times your current salary. Between 51 and 55, 6.1 times your current salary. Between 56 and 60, 7.7 times your current salary. Between 61 and 64, 9.2 times your current salary.

Source: Chief Investment Office and Workplace Benefits, "Financial Wellness: Helping improve the financial lives of your employees," 2025. Note: Calculations are based on obtaining 38% of income replacement from retirement savings (pre-tax) for middle-income households earning $40,000 to $100,000 annually.

Just how big your nest egg should be and how long it might last will depend not only on what you save and invest, but also how you plan to spend money once you retire. Do you plan to

work part time in retirement? Travel a lot? At what age do you plan to retire? Answers to all these questions will help you figure out how large a nest egg you may need to live the life you want in retirement. And don't forget to factor in inflation and future market conditions.

Will your savings be enough for the retirement income you'll need?

You may be surprised how much — or how little — even generously sized accounts could potentially provide over the course of a retirement. The examples below illustrate how much a 65-year-old can safely withdraw in the first year of retirement.

Annual income

from savings*

Savings value at age 65 is $300,000

Annual income from savings, see footnote asterisk, is $12,000/year

Savings value at age 65 is $1,000,000

Annual income from savings, see footnote asterisk, is $40,000/year

Savings value at age 65 is $1,500,000

Annual income from savings, see footnote asterisk, is $60,000/year

Footnote *The accumulated investment savings by age 65 could provide an annual retirement income, adjusted for future inflation (in today's dollars), of this amount for life if withdrawn at a spending rate of 4%. This example is for illustrative purposes only, as the amount in hand will differ due to the tax implications if the assets are held in a pre-tax or post-tax account (or a combination of both), as well as due to an individual's personal circumstances.

Source: Chief Investment Office. Illustration is for hypothetical purposes only.

The potential impact of taxes also plays a role. Saving money in a pre-tax account such as a traditional 401(k) plan is very different from saving in a Roth IRA, funded by after-tax dollars, due to the tax treatment at the time of distribution. Understanding

the key differences between IRAs is critical when planning for retirement.

Start by calculating your future expenses

"Having a specific percentage or dollar amount savings goal can be helpful, but you can't be focused solely on that," Storey says. "Everybody's lifestyle is different, and how they spend their retirement may be very different as well." He suggests trying to create a ballpark annual estimate based on what you live on now and how your expenses might change when you retire.

Remember, although some costs — such as

healthcare — may increase in retirement, there could be savings elsewhere. "Researchers have found that retirees spend more time shopping carefully and preparing meals at home, for example. Their cost of living for items such as these goes down," Storey says.

Data from the U.S. Bureau of Labor Statistics found that overall spending tends to drop in retirement — and that smaller pie gets cut up differently. Average out-of-pocket spending on healthcare rises from 12% of household budgets for those between the ages of 65 to 74 to more than 15% after people turn 75. Transportation expenses, on the other hand, fall from about 17% of spending for households headed by a person 65 to 74 to about 12% once they reach age 75.Footnote 2 Understanding how your costs can change as you age can help you plan for future household expenses.

Next, add up all your potential income sources

As you explore how much money you may need in retirement, remember that the amount you decide to save and invest is only one component of your future retirement income.

Most Americans will have

Social Security as the backbone of their retirement savings. (Even if benefit payments are reduced in the future, Social Security is not likely to go away.) And don't forget about

other sources of income that may be available to you many years from now, including the money in your workplace and personal retirement accounts, pensions, annuities, proceeds from selling your home or business, rental income or an inheritance.

Plan ahead to close any gaps

Understanding your post-retirement expenses and potential income can help you estimate how much you may need to draw from your savings each year in retirement. However, it can be tough to turn that goal into a realistic amount to invest today when your goal may be decades away. To see where you are now and what you might need to change in the future, try the

Personal Retirement Calculator. This checkpoint gives you a projection of your savings to see if there is a gap between what you'll have and what you'll need so you can adjust your strategy if necessary.

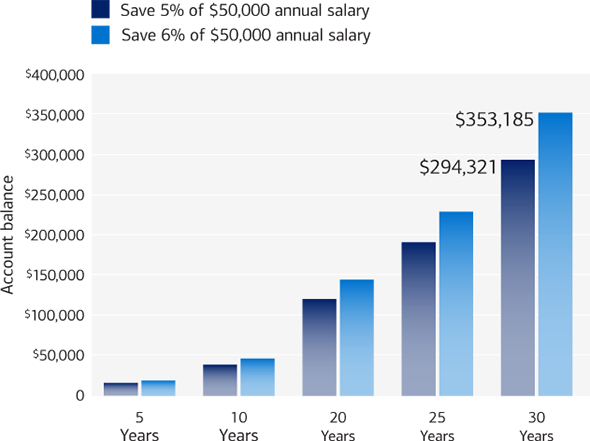

The difference 1% can make

A small change in retirement contributions could give you more savings after 30 years.

If you have a $50,000 annual salary, saving 6% rather than 5% would give you more retirement savings after 5, 10, 20 and 25 years. By the time you reached the 30-year mark, you could potentially have an account balance of $309,018 if you saved 6% of your salary compared to an account balance of $257,515 if you saved 5% of your salary.

If you have a $50,000 annual salary, saving 6% rather than 5% would give you more retirement savings after 5, 10, 20 and 25 years. By the time you reached the 30-year mark, you could potentially have an account balance of $309,018 if you saved 6% of your salary compared to an account balance of $257,515 if you saved 5% of your salary.

Source: Chief Investment Office, August 2025. This hypothetical example assumes a salary of $50,000, 5% and 6% pre-tax contribution rates at the beginning of each year, and a 7.1% annual effective rate of return. Hypothetical results are for illustrative purposes only and are not meant to represent the past or future performance of any specific investment vehicle. Investment return and principal value will fluctuate, and when redeemed, the investments may be worth more or less than their original cost. Actual investing includes fees and other expenses that may result in lower returns than this hypothetical example. Income taxes are due upon withdrawal. If you take a withdrawal prior to age 59½, you may also be subject to a 10% additional federal tax, unless an exception applies.

But even if this checkpoint shows that you're behind where you might be, don't get discouraged, advises Storey. You have options, such as taking advantage of

catch-up contributions and reviewing your asset allocation and risk tolerance. Is there an opportunity to invest for more potential growth? If there's still a savings gap as you near retirement, you might want to explore working a little longer or working part time during retirement. "If you need to save more, even a 1% increase can mean a lot over time," he says. Whatever you save and invest today for the long term can make a big difference in the future.

Estimating your retirement income needs is not an exact science. No matter your life stage or how much you've saved, a careful review of your expected needs and sources of income can help you prepare for the years ahead.

Share:

Footnote 1 Chief Investment Office and Workplace Benefits, "Financial Wellness: Helping improve the financial lives of your employees," 2025.

Footnote 2 U.S. Bureau of Labor Statistics, Table 1300: "Age of Reference Person," Consumer Expenditure Surveys 2023.

MAP8542377-05072027