Can your retirement plan handle changes to Social Security?

Share:

A potential funding shortfall could reduce your benefit. Here's how to be financially ready no matter what happens.

The clock is ticking for Congress to come up with a solution to continue funding Social Security at current spending levels. That's the conclusion of the Board of Trustees of the Social Security and Medicare trust funds, which in recent years has projected that the program may be unable to pay scheduled benefits in full and on time at some point within the next decade.Footnote 1

As more Americans reach retirement age, concerns about the program's future solvency have risen. Though Social Security was never intended to be the sole source of retirement income, many younger Americans are realizing that the size of that monthly payment when they retire may be smaller than they'd anticipated. According to a July 2024 survey from Nationwide, 79% of 28- to 43-year-olds worry the Social Security system will run out of funding in their lifetime.Footnote 2

"While a funding solution is likely to be found for this critical retirement program that's supported millions of Americans since the 1930s, it's not a bad idea for retirement savers to review their own retirement funding plans and stay aware of developments in Congress," says Anil Suri, a managing director in the Chief Investment Office for Merrill and Bank of America Private Bank.

"As baby boomers continue to retire, Social Security payouts are increasing a lot faster than contributions."Footnote 3

— Anil Suri,

managing director, Chief Investment Office,

Merrill and Bank of America Private Bank

How is Social Security funded, and what is its current status?

How is Social Security funded, and what is its current status?

Social Security funding comes mainly from employer and employee payroll taxes of 6.2% each (12.4% total) on wages up to a certain limit ($176,100 in 2025). The challenge: The number of retirees claiming benefits is rising, while the number of working-age people contributing to Social Security via payroll taxes is declining. "As baby boomers continue to retire, Social Security payouts are increasing a lot faster than contributions," Suri says.Footnote 3

If the Social Security trust fund becomes insolvent — meaning it is unable to pay benefits in full and on time — it's not entirely clear what will happen, Suri notes. "Insolvency does not mean that Social Security will be completely eliminated and unable to pay any benefits," he adds. But future benefits can only be paid from taxes collected, and those taxes are projected to cover only about 80% of scheduled benefits in the years to come. Since current contributions wouldn't meet the full obligations, recipients might receive timely but reduced payments or be paid in full but on a delayed schedule.

Insolvency does not mean that Social Security will be completely eliminated and unable to pay any benefits.

— Anil Suri,

managing director, Chief Investment Office,

Merrill and Bank of America Private Bank

What are some potential fixes?

What are some potential fixes?

Potential solutions approach the shortfall in different ways. Some would increase the amount available to make future Social Security payouts, while others would reduce the amount in benefits that are paid each year.

Options include:

- Increasing the full retirement age and the age at which you can receive benefits early

- Hiking the payroll tax on wages over a certain amount

- Decreasing benefits for higher lifetime earners

- Reducing the cost-of-living adjustment

- Changing the formula used to calculate the benefitFootnote 4

Should I claim benefits early?

Should I claim benefits early?

Potential cuts to Social Security might tempt you to start collecting benefits earlier than planned. In fact, from October 2024 to April 2025, retirement claims were up by 13% compared with the same period a year earlier, with more people claiming Social Security early, according to a report by the Urban

Institute.Footnote 5 But claiming before your full retirement age reduces your benefits — for life. That can be an important consideration for younger people who are still saving and may need to plan for a lifetime that could reach age 100 or beyond.

Try our Social Security Calculator to estimate your benefits at different claiming ages.

The advantages of delaying your Social Security benefit

For every year you wait to collect Social Security up to age 70, your monthly benefits increase by about 8% per year. See how much of a difference that can make.

| Age |

Annual benefit amount |

| 62 |

$30,516 |

| 63 |

$32,940 |

| 64 |

$35,520 |

| 65 |

$38,748 |

| 66 |

$42,000 |

| 67 |

$45,396 |

| 68 |

$49,332 |

| 69 |

$53,304 |

| 70 |

$56,700 |

Note: Full retirement age is the age at which a person may first become entitled to full or unreduced Social Security benefits. In this hypothetical example, these figures assume a full retirement age of 67 and a $200,000 salary upon retirement. Benefit estimates are in today's dollars.

Source: Social Security Quick Calculator, accessed July 2025.

How should I adjust my retirement savings and investments?

How should I adjust my retirement savings and investments?

Most proposals for Social Security solvency involve higher payroll taxes rather than cuts in benefits, Suri notes. Still, the possibility of lower benefits provides another incentive to invest in tax-advantaged retirement savings plans and boost your contributions when you can. Even a small bump to your savings rate can make a big difference.

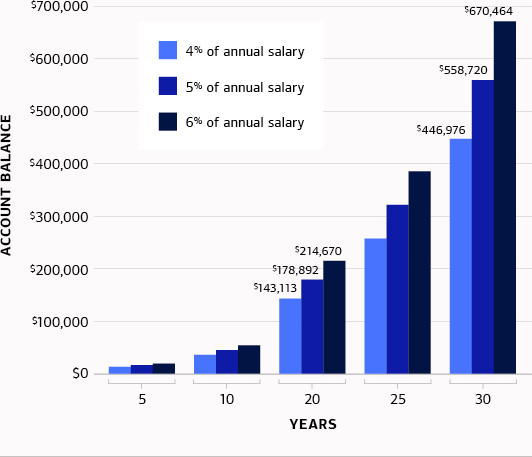

Saving a little extra can have a supersize effect

Just increasing your contribution rate from 4% to 6% could add more than $70,000 to your nest egg over 20 years, or $200,000 over 30 years, assuming a $50,000 starting salary that increases each year.

At 5 years, a hypothetical investor would have $12,900 if they saved 4% of their income, $16,125 if they saved 5% of their income and $19,350 if they saved 6% of their income. At 10 years, a hypothetical investor would have $35,842 if they saved 4% of their income, $44,802 if they saved 5% of their income and $53,762 if they saved 6% of their income. At 20 years, a hypothetical investor would have $143,113 if they saved 4% of their income, $178,892 if they saved 5% of their income and $214,670 if they saved 6% of their income. At 25 years, a hypothetical investor would have $256,856 if they saved 4% of their income, $321,070 if they saved 5% of their income and $385,284 if they saved 6% of their income. At 30 years, a hypothetical investor would have $446,976 if they saved 4% of their income, $558,720 if they saved 5% of their income and $670,464 if they saved 6% of their income.

At 5 years, a hypothetical investor would have $12,900 if they saved 4% of their income, $16,125 if they saved 5% of their income and $19,350 if they saved 6% of their income. At 10 years, a hypothetical investor would have $35,842 if they saved 4% of their income, $44,802 if they saved 5% of their income and $53,762 if they saved 6% of their income. At 20 years, a hypothetical investor would have $143,113 if they saved 4% of their income, $178,892 if they saved 5% of their income and $214,670 if they saved 6% of their income. At 25 years, a hypothetical investor would have $256,856 if they saved 4% of their income, $321,070 if they saved 5% of their income and $385,284 if they saved 6% of their income. At 30 years, a hypothetical investor would have $446,976 if they saved 4% of their income, $558,720 if they saved 5% of their income and $670,464 if they saved 6% of their income.

Note: This hypothetical example assumes a 7.8% return and a 2.5% salary increase each year. Investing in securities involves risk, and there is always the potential of losing money when you invest in securities.

Source: Bankrate 401(k) retirement savings calculator, accessed July 2025.

Are there additional strategies I should consider?

Are there additional strategies I should consider?

If you're worried that you won't have the regular income stream you were depending on with Social Security, consider investing a portion of your savings in an annuity. These insurance contracts can be set up to:

- Offer tax-deferred growth on your assets.

- Provide regular payments for life or for a time specified in the contract.

Working part time or consulting in your spare time could also provide an income stream during retirement.

Whether you're nearing retirement or already there, it may be a good idea to invest some time now in understanding your options and strengthening your personal plan.

Share:

Footnote 1 Social Security Administration, "The 2025 Annual Report of the Board of Trustees of the Federal Old-Age and Survivors Insurance and Federal Disability Insurance Trust Funds," June 2025.

Footnote 2 Nationwide, "More than three in four U.S. adults believe the Social Security system needs to change," July 30, 2024.

Footnote 3 Social Security Administration, "2025 Trustees Report."

Footnote 4 Urban Institute, "DYNASIM: Visualizing Older Americans' Future Well-Being," accessed July 2025.

Footnote 5 Urban Institute, "More Americans Are Filing for Retirement Benefits Earlier — Their Long-Term Retirement Security Could Suffer as a Result," May 23, 2025.

MAP8262829-03052027