Growth vs. value: two approaches to stock investing

Growth and value are two fundamental approaches, or styles, in stock and stock mutual fund investing.Footnote 1 Growth investors seek companies that offer strong earnings growth while value investors seek stocks that appear to be undervalued in the marketplace. Because the two styles complement each other, they can help add diversity to your portfolio when used together.

Growth and value defined

Growth stocks represent companies that have demonstrated better-than-average gains in earnings in recent years and that are expected to continue delivering high levels of profit growth, although there are no guarantees. "Emerging" growth companies are those that have the potential to achieve high earnings growth, but have not established a history of strong earnings growth.

The key characteristics of growth funds are as follows:

- Higher priced than broader market. Investors are willing to pay high price-to-earnings multiples with the expectation of selling them at even higher prices as the companies continue to grow

- High earnings growth records. While the earnings of some companies may be depressed during periods of slower economic improvement, growth companies may potentially continue to achieve high earnings growth regardless of economic conditions

- More volatile than broader market. The risk in buying a given growth stock is that its lofty price could fall sharply on any negative news about the company, particularly if earnings disappoint Wall Street

Value fund managers look for companies that have fallen out of favor but still have good fundamentals. The value group may also include stocks of new companies that have yet to be recognized by investors.

The key characteristics of value funds include:

- Lower priced than broader market. The idea behind value investing is that stocks of good companies will bounce back in time if and when the true value is recognized by other investors

- Priced below similar companies in industry. Many value investors believe that a majority of value stocks are created due to investors' overreacting to recent company problems, such as disappointing earnings, negative publicity or legal problems, all of which may raise doubts about the company's long-term prospects.

- Carry somewhat less risk than broader market. However, as they take time to turn around, value stocks may be more suited to longer term investors and may carry more risk of price fluctuation than growth stocks

Growth or value... or both?

Which strategy — growth or value — is likely to produce higher returns over the long term? The battle between growth and value investing has been going on for years, with each side offering statistics to support its arguments. Some studies show that value investing has outperformed growth over extended periods of time on a value-adjusted basis. Value investors argue that a short-term focus can often push stock prices to low levels, which creates great buying opportunities for value investors.

History shows us that:

- Growth stocks, in general, have the potential to perform better when interest rates are falling and company earnings are rising. However, they may also be the first to be punished when the economy is cooling.

- Value stocks, often stocks of cyclical industries, may do well early in an economic recovery but are typically more likely to lag in a sustained bull market

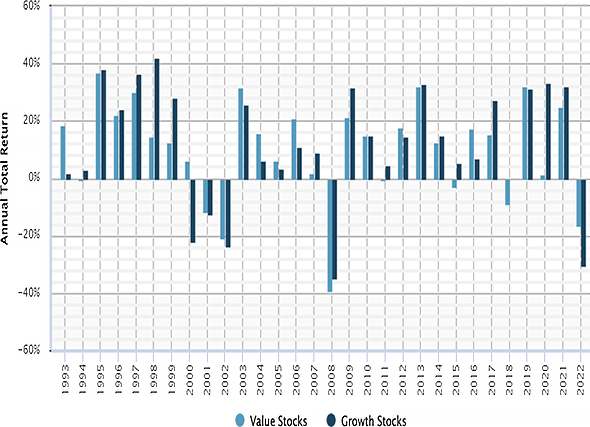

Growth vs. Value: Compare the Performance

The chart shows the annual total return of growth and value stocks for the 30 years ended December 31, 2022. In 1993, growth stocks had a total return of 1.68%, and value stocks had a total return of 18.61%. In 1994, growth stocks had a total return of 3.13%, and value stocks had a total return of -0.64%. In 1995, growth stocks had a total return of 38.13%, and value stocks had a total return of 36.99%. In 1996, growth stocks had a total return of 23.97%, and value stocks had a total return of 22.00%. In 1997, growth stocks had a total return of 36.52%, and value stocks had a total return of 29.98%. In 1998, growth stocks had a total return of 42.16%, and value stocks had a total return of 14.67%. In 1999, growth stocks had a total return of 28.25%, and value stocks had a total return of 12.72%. In 2000, growth stocks had a total return of -22.08%, and value stocks had a total return of 6.08%. In 2001, growth stocks had a total return of -12.73%, and value stocks had a total return of -11.71%. In 2002, growth stocks had a total return of -23.59%, and value stocks had a total return of -20.85%. In 2003, growth stocks had a total return of 25.66%, and value stocks had a total return of 31.79%. In 2004, growth stocks had a total return of 6.13%, and value stocks had a total return of 15.71%. In 2005, growth stocks had a total return of 3.46%, and value stocks had a total return of 6.34%. In 2006, growth stocks had a total return of 10.99%, and value stocks had a total return of 20.79%. In 2007, growth stocks had a total return of 9.15%, and value stocks had a total return of 1.99%. In 2008, growth stocks had a total return of -34.91%, and value stocks had a total return of -39.22%. In 2009, growth stocks had a total return of 31.60%, and value stocks had a total return of 21.18%. In 2010, growth stocks had a total return of 15.14%, and value stocks had a total return of 15.10%. In 2011, growth stocks had a total return of 4.65%, and value stocks had a total return of -0.48%. In 2012, growth stocks had a total return of 14.61%, and value stocks had a total return of 17.68%. In 2013, growth stocks had a total return of 32.75%, and value stocks had a total return of 31.99%. In 2014, growth stocks had a total return of 14.89%, and value stocks had a total return of 12.36%. In 2015, growth stocks had a total return of 5.52%, and value stocks had a total return of -3.13%. In 2016, growth stocks had a total return of 6.89%, and value stocks had a total return of 17.14%. In 2017, growth stocks had a total return of 27.44%, and value stocks had a total return of 15.36%. In 2018, growth stocks had a total return of -0.01%, and value stocks had a total return of -8.95%. In 2019, growth stocks had a total return of 31.13%, and value stocks had a total return of 31.93%. In 2020, growth stocks had a total return of 33.47%, and value stocks had a total return of 1.37%. In 2021, growth stocks had a total return of 32.01%, and value stocks had a total return of 24.90%. In 2022, growth stocks had a total return of -29.41%, and value stocks had a total return of -5.22%.

The chart shows the annual total return of growth and value stocks for the 30 years ended December 31, 2022. In 1993, growth stocks had a total return of 1.68%, and value stocks had a total return of 18.61%. In 1994, growth stocks had a total return of 3.13%, and value stocks had a total return of -0.64%. In 1995, growth stocks had a total return of 38.13%, and value stocks had a total return of 36.99%. In 1996, growth stocks had a total return of 23.97%, and value stocks had a total return of 22.00%. In 1997, growth stocks had a total return of 36.52%, and value stocks had a total return of 29.98%. In 1998, growth stocks had a total return of 42.16%, and value stocks had a total return of 14.67%. In 1999, growth stocks had a total return of 28.25%, and value stocks had a total return of 12.72%. In 2000, growth stocks had a total return of -22.08%, and value stocks had a total return of 6.08%. In 2001, growth stocks had a total return of -12.73%, and value stocks had a total return of -11.71%. In 2002, growth stocks had a total return of -23.59%, and value stocks had a total return of -20.85%. In 2003, growth stocks had a total return of 25.66%, and value stocks had a total return of 31.79%. In 2004, growth stocks had a total return of 6.13%, and value stocks had a total return of 15.71%. In 2005, growth stocks had a total return of 3.46%, and value stocks had a total return of 6.34%. In 2006, growth stocks had a total return of 10.99%, and value stocks had a total return of 20.79%. In 2007, growth stocks had a total return of 9.15%, and value stocks had a total return of 1.99%. In 2008, growth stocks had a total return of -34.91%, and value stocks had a total return of -39.22%. In 2009, growth stocks had a total return of 31.60%, and value stocks had a total return of 21.18%. In 2010, growth stocks had a total return of 15.14%, and value stocks had a total return of 15.10%. In 2011, growth stocks had a total return of 4.65%, and value stocks had a total return of -0.48%. In 2012, growth stocks had a total return of 14.61%, and value stocks had a total return of 17.68%. In 2013, growth stocks had a total return of 32.75%, and value stocks had a total return of 31.99%. In 2014, growth stocks had a total return of 14.89%, and value stocks had a total return of 12.36%. In 2015, growth stocks had a total return of 5.52%, and value stocks had a total return of -3.13%. In 2016, growth stocks had a total return of 6.89%, and value stocks had a total return of 17.14%. In 2017, growth stocks had a total return of 27.44%, and value stocks had a total return of 15.36%. In 2018, growth stocks had a total return of -0.01%, and value stocks had a total return of -8.95%. In 2019, growth stocks had a total return of 31.13%, and value stocks had a total return of 31.93%. In 2020, growth stocks had a total return of 33.47%, and value stocks had a total return of 1.37%. In 2021, growth stocks had a total return of 32.01%, and value stocks had a total return of 24.90%. In 2022, growth stocks had a total return of -29.41%, and value stocks had a total return of -5.22%.

Both growth and value stocks have taken turns leading and lagging one another during different markets and economic conditions.

Source: ChartSource®, SS&C Retirement Solutions, LLC. For the period from January 1, 1993, through December 31, 2022. Growth stocks are represented by a composite of the S&P 500/BARRA Growth index and the S&P 500/Citi Growth index. Value stocks are represented by a composite of the S&P 500/BARRA Value index and the S&P 500/Citi Value index. It is not possible to invest directly in an index. Index performance does not reflect the effects of investing costs and taxes. Actual results would vary from benchmarks and would likely have been lower. Past performance is not a guarantee of future results. © 2023 SS&C. Reproduction in whole or in part prohibited, except by permission. All rights reserved. Not responsible for any errors or omissions. (T2C30)

When investing long term, some individuals combine growth and value stocks or funds for the potential of high returns with less risk. This approach allows investors to, in theory, gain throughout economic cycles in which the general market situations favor either the growth or value investment style, smoothing any returns over time.

Footnote 1 Investing in growth stocks incurs the possibility of losses because their prices are sensitive to changes in current or expected earnings. Value stocks are securities of companies that may have experienced adverse business or industry developments or may be subject to special risks that have caused the stocks to be out of favor. If the manager's assessment of a company's prospects is wrong, the price of the stock may not approach the value the manager has placed on it.

© SS&C. Reproduction in whole or in part prohibited, except by permission. All rights reserved. Not responsible for any errors or omissions.

The material was authored by a third party, DST Retirement Solutions, LLC, an SS&C company ("SS&C"), not affiliated with Merrill or any of its affiliates and is for information and educational purposes only. The opinions and views expressed do not necessarily reflect the opinions and views of Merrill or any of its affiliates. Any assumptions, opinions and estimates are as of the date of this material and are subject to change without notice. Past performance does not guarantee future results. The information contained in this material does not constitute advice on the tax consequences of making any particular investment decision. This material does not take into account your particular investment objectives, financial situations or needs and is not intended as a recommendation, offer or solicitation for the purchase or sale of any security, financial instrument, or strategy. Before acting on any recommendation in this material, you should consider whether it is in your best interest based on your particular circumstances and, if necessary, seek professional advice.

Because of the possibility of human or mechanical error by SS&C or its sources, neither SS&C nor its sources guarantees the accuracy, adequacy, completeness or availability of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. In no event shall SS&C be liable for any indirect, special or consequential damages in connection with subscriber's or others' use of the content.

Merrill, its affiliates, and financial advisors do not provide legal, tax, or accounting advice. You should consult your legal and/or tax advisors before making any financial decisions.

MAP6560050-06212024