Options involve risk and are not suitable for all investors. Certain requirements must be met to trade options. Before engaging in the purchase or sale of options, investors should understand the nature of and extent of their rights and obligations and be aware of the risks involved in investing with options. Please read the options disclosure document titled "Characteristics and Risks of Standardized Options (PDF)" before considering any option transaction. You may also call the Investment Center at 877.653.4732 for a copy. A separate client agreement is needed. Options contracts are assessed a per-contract charge and may incur an additional per trade commission for rep-assisted orders.

The maximum loss, gain and breakeven of any options strategy only remains as defined so long as the strategy contains all original positions. Trading, rolling, assignment, or exercise of any portion of the strategy will result in a new maximum loss, gain and breakeven calculation, which will be materially different from the calculation when the strategy remains intact with all of the contemplated legs or positions. This is applicable to all options strategies inclusive of long options, short options and spreads. To learn more about Merrill's uncovered option handling practices, view

Naked Option Stress Analysis (NOSA) (PDF).

Early assignment risk is always present for option writers (specific to American-style options only). Early assignment risk may be amplified in the event a call writer is short an option during the period the underlying security has an ex-dividend date. This is referred to as dividend risk.

Long options are exercised and short options are assigned. Note that American-style options can be assigned/exercised at any time through the day of expiration without prior notice. Options can be assigned/exercised after market close on expiration day. View specific

Merrill Option Exercise & Assignment Practices (PDF).

Supporting documentation for any claims, comparison, recommendations, statistics, or other technical data, will be supplied upon request.

Please read the options disclosure document (PDF)

Select to close help pop-up

The amount by which an option is in-the-money

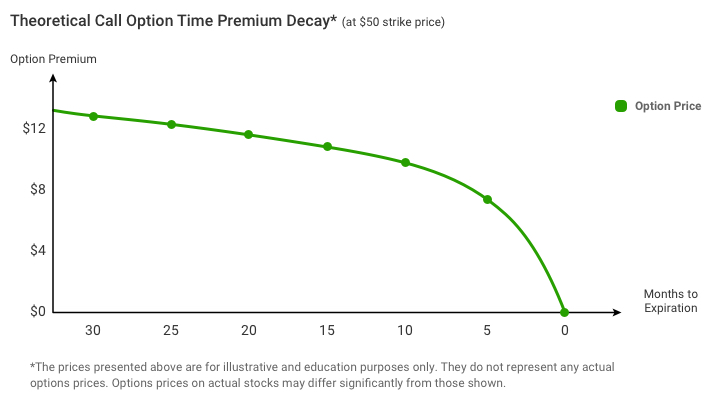

Time premium erosion works in favor of short-term option sellers. Conversely, the option buyer must overcome the erosion of time premium to profit from a long option position. The graph below is a representation of theoretical time erosion for longer-dated options:

For illustrative purposes only.

Note: The prices presented in this graph are for illustrative and educational purposes only. They do not represent any actual options prices and are not intended to. Options prices on actual stocks may differ significantly from those shown.

As you can see from the graph, time erosion of options premium is not linear (i.e., it does not occur in a straight line). The mathematical reasons for this are complex.

The result is that the erosion of time premium in the earlier months of an option's life is much less dramatic than the erosion that occurs in the last few months. Because of the long timeframe of LEAPS® options, this effect is even more pronounced. The time erosion that occurs in the first several months of a LEAPS® option is minimal.

However, when LEAPS® options become shorter-term options (time to expiration is less than one year), they behave like all other shorter-term options, as the graph shows. Time erosion becomes more pronounced and has a greater impact, especially in the last 90 days of the option's life.

What does this mean to options investors?

- Buyers of LEAPS® options have less time premium erosion to fight than buyers of shorter-dated options.

- LEAPS® options offer less leverage..

- The Deltas of LEAPS® options will not increase as dramatically as with shorter-dated options since there is so much time remaining until expiration.

- A lower Gamma tempers any drastic changes to an option's Delta due to the amount of time until expiration.

Content licensed from the Options Industry Council is intended to educate investors about U.S. exchange-listed options issued by The Options Clearing Corporation, and shall not be construed as furnishing investment advice or being a recommendation, solicitation or offer to buy or sell any option or any other security. Options involve risk and are not suitable for all investors.

Content licensed from the Options Industry Council. All Rights Reserved. OIC or its affiliates shall not be responsible for content contained on Merrill's Website, or other Company Materials not provided by OIC. OIC education can be accessed at the

OIC web site popup.

Without the Jargon

Select to close help pop-up

A call option is out of the money if the strike price is greater than the market price of the underlying security. A put option is out of the money if the strike price is less than the market price of the underlying security.

Information not provided by the Options Industry Council