Retirement savings catch-up: Steps to consider now

Even if it feels like time is running short, you can still take steps to help stay on track for the retirement you want.

As you approach retirement, you may be concerned that your retirement nest egg is not as large as you'd planned. But no matter where you are in the retirement planning process or how much you've socked away, you may be able to do more to help prepare for a comfortable retirement. "It's never too late to get started," says Debra Greenberg, director of Investment Solutions & Personal Retirement at Bank of America. Here are five steps to consider that can help get you closer to the comfortable retirement you desire.

It's never too late to get started.

— Debra Greenberg,

director, Investment Solutions & Personal Retirement,

Bank of America

1. Put away a little more

Beginning in the calendar year in which you turn 50, you're allowed to make annual catch-up contributions to a 401(k) plan, provided you are eligible under the terms of the plan, and an individual retirement account (IRA). That's in addition to the regular contribution limits for that year. If you have turned 50 and haven't yet taken advantage of this catch-up opportunity, you can start now.

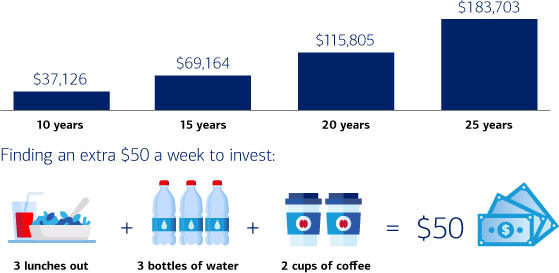

Contributing a little extra to your retirement investments each month could yield rewards later. For example, putting an additional $50 a week toward retirement — what you might save by bringing your lunch from home instead of grabbing something at work — could, after 10 years, yield an additional $37,126 in your retirement pot. After 20 years, that sum could potentially grow to more than $115,000 as the hypothetical illustration below shows.Footnote 1 If you can't find the extra cash now, consider pledging to increase the amount of your contribution if you receive a salary increase, bonus or tax refund.

If you invested an extra $50 a week

Imagine taking the money you spend on little splurges — a few takeout lunches or a couple cups of coffee — and investing it in your retirement account. As shown below, a bit of sacrifice and reinvestment could potentially really add up over time.*

Finding an extra $50 a week to invest: Three lunches out plus three bottles of water plus two cups of coffee would cost you approximately $50. If you took that $50 four times a month and invested it, in 10 years you would have $37,126, in 15 years you would have $69,164, in 20 years you would have $115,805, and in 25 years you would have $183,703.

Finding an extra $50 a week to invest: Three lunches out plus three bottles of water plus two cups of coffee would cost you approximately $50. If you took that $50 four times a month and invested it, in 10 years you would have $37,126, in 15 years you would have $69,164, in 20 years you would have $115,805, and in 25 years you would have $183,703.*Assumes four weekly contributions per month at an annual rate of return of 7.8%, compounded monthly for the stated number of years. Prices for goods assume $4.00/cup of brewed coffee, $12.50/lunch eaten out and $1.50/bottle of water.

Also, if you have a mortgage, consider refinancing to find additional dollars you can invest. Lower payments could reduce expenses, which could provide more funds to invest in your retirement. (With interest rates higher than in recent years, refinancing might not reduce your payments now.) Also weigh your closing costs against how long you plan to stay in your home and other factors to

determine if refinancing is a smart move for you.

2. Work a little longer

Postponing retirement can make a lot of sense. "Many of us are healthier at age 65 than the average retiree of our parents' generation," Greenberg says. Working a year or two longer can not only boost your savings considerably but also give your investments more time to potentially grow before you begin drawing on them for income. What's more, you won't have to stretch your retirement assets over as many years.

Staying in your current job may not be the only option when it comes to working longer. Consider whether you'd like to work closer to home, for example, or in a field you're more passionate about. But keep in mind that it could be risky to rely on working as your sole way of boosting retirement income. Indeed, according to the 2023 Retirement Confidence Survey by the Employee Benefit Research Institute and Greenwald Research, 73% of workers say they expect to work for pay in retirement, but only 23% of current retirees report actually doing so.Footnote 2 That suggests that outside factors may get in the way.

3. Defer taking Social Security

You can opt to start taking reduced benefits as early as age 62. But if you wait until your full retirement age (age 66-67 based on date of birth), you will receive 100% of your retirement benefit, and each year you delay beyond full retirement age, your monthly benefit grows until age 70 when you earn the maximum delayed retirement credits. The additional income can add up quickly. In fact, for an individual who reached age 62 in 2023 and who would have a full retirement age benefit of $1,000 per month upon reaching full retirement age, delaying Social Security retirement benefits until age 70 instead of collecting at age 62 could potentially increase the lifetime monthly benefit by about 77%.Footnote 3 For a couple, both of whom reached age 62 in 2023, that could mean an increase in lifetime benefits of more than $134,000, assuming average life expectancies.Footnote 4 The difference would vary based on your actual Social Security benefit.

Greenberg recommends that you consider tapping into other assets to cover expenses or spend less rather than drawing Social Security too early.

4. Rethink your housing situation

If you no longer need the space you once did, consider downsizing. Reduced living costs — including transportation as well as housing and maintenance expenses — could free up cash to put into savings, and you could invest any profits from the sale of your home. You might even think about moving to a neighboring town with lower property tax rates, or to a state with no personal income tax. Talk to your tax advisor to determine whether relocating might present an opportunity for you.

If you plan to stay in the same place through your retirement years, consider factors such as your future ability to climb stairs and whether you'll have reasonable access to stores and doctors' offices when you no longer may be able to drive.

5. Realign your portfolio

Your asset allocationFootnote 5 should typically become more conservative as you approach retirement. But consider continuing to hold some stocks or stock funds for potential asset growth to help offset inflation, since you could spend 20 to 30 years in retirement. "The main priority," Greenberg says, "is to have a disciplined approach to investing."

Footnote 1 This hypothetical illustration assumes a 7.8% annual effective rate of return and was not adjusted for inflation. Had a different rate been applied, the results would have been different. Hypothetical results are for illustrative purposes only and are not meant to represent the past or future performance of any specific investment vehicle. Investment return and principal value will fluctuate, and when redeemed the investments may be worth more or less than their original cost. Taxes may be due upon withdrawal. If you take a withdrawal prior to age

59½, you may also be subject to a 10% additional tax, unless an exception applies.

Footnote 2 Employee Benefit Research Institute and Greenwald Research, 2023 Retirement Confidence Survey,

EBRI Chartbook (Employee Benefit Research Institute, April 27, 2023), accessed January 2024.

Footnote 3 This example is based on an individual who reached age 62 in 2023 (correlating to a full retirement age of 67) and whose full retirement age benefit is $1,000. Social Security Administration, "When to Start Receiving Retirement Benefits," January 2023, accessed January 2024.

Footnote 4 Assumes a couple with full retirement age benefit of $1,000 each with a 2.83% annual cost of living adjustment. Merrill Lynch Social Security Analyzer, accessed December 2023.

Footnote

Asset allocation, diversification, and rebalancing do not ensure a profit or protect against loss in declining markets.

Merrill, its affiliates, and financial advisors do not provide legal, tax, or accounting advice. You should consult your legal and/or tax advisors before making any financial decisions.

MAP6317441-08152025